Business inventories and GDP are essential topics that shape our understanding of economic health and business decision-making. As we explore the relationship between how companies manage their inventory and its influence on overall economic growth, we discover insights that matter to businesses, policymakers, and anyone curious about what drives the economy forward.

Inventories represent everything from raw materials to finished goods, serving as indicators of business confidence and future demand. The ways in which companies handle their stock not only affect their own operations but also send signals about the wider economy, impacting GDP calculations and economic forecasts. Understanding these dynamics equips us to better interpret economic data and anticipate market trends.

Understanding Business Inventories: Business Inventories And Gdp

Business inventories refer to the goods and materials that companies hold at various stages of production before reaching the final consumer. Managing these inventories efficiently is crucial, as it directly affects a company’s operational efficiency, costs, and ability to meet market demand. Generally, business inventories are classified into three main types based on their stage in the production process.

Types of Business Inventories, Business inventories and gdp

There are three fundamental categories of inventories found across industries. Each type plays a distinct role in the operational workflow, and managing them effectively is key to maintaining a smooth supply chain.

| Inventory Type | Description | Example |

|---|---|---|

| Raw Materials | Basic inputs and components that are yet to be processed or assembled. | Steel used in car manufacturing, flour in a bakery |

| Work-in-Process (WIP) | Goods that are in the middle of the production process but not yet finished products. | Half-assembled electronics, unbaked bread dough |

| Finished Goods | Products that have completed the manufacturing process and are ready for sale to customers. | Smartphones in a distributor’s warehouse, packaged loaves of bread |

Importance of Inventory Management for Businesses

Effective inventory management is essential for maintaining product availability, controlling costs, and optimizing cash flow. Companies that can balance their inventory efficiently avoid unnecessary holding costs and reduce the risk of stockouts, which can disrupt sales and customer satisfaction. Moreover, well-managed inventories contribute to a company’s profitability and operational resilience, especially during supply chain disruptions or demand fluctuations.

The Role of Business Inventories in the Economy

Inventory levels serve as a valuable economic indicator, reflecting business confidence and expectations about future demand. When companies anticipate strong sales, they tend to build up inventories; conversely, when demand is expected to decline, businesses may scale back on inventory accumulation.

Inventory Levels as Economic Indicators

Rising or falling inventories signal shifts in business sentiment and overall market conditions. For instance, a rapid buildup of unsold goods can indicate over-optimism about market demand, while shrinking inventories may suggest caution or robust sales.

Relationship Between Inventory Accumulation and Business Cycles

The accumulation and reduction of business inventories are closely linked to the phases of the business cycle. During economic expansions, companies often increase inventories to keep up with growing demand. In downturns, they may reduce stockpiles to minimize costs and avoid excess unsold products, which can intensify economic slowdowns.

Factors Influencing Inventory Changes Across Industries

Industry-specific conditions shape how businesses handle inventory. The following key points highlight the main drivers behind inventory adjustments in different sectors:

- Seasonal demand variations affecting retail and agriculture

- Technological advancements requiring just-in-time inventory in electronics

- Supply chain disruptions impacting manufacturing stock levels

- Shifting consumer preferences driving adjustments in fashion and consumer goods

- Regulatory requirements influencing inventory holding in pharmaceuticals

Each of these factors requires tailored strategies to maintain optimal inventory levels and respond proactively to market shifts.

Business Inventories and Their Impact on GDP

Changes in business inventories play a direct role in the calculation of Gross Domestic Product (GDP), as they represent a component of investment in the national accounts. Inventory fluctuations can amplify or dampen economic growth rates from quarter to quarter.

Inventory Changes in GDP Calculation

GDP measures the value of all goods and services produced within a country. The calculation includes the change in inventories, which captures goods produced but not yet sold. When companies add to their inventories, it contributes positively to GDP. Conversely, when inventories are drawn down, it subtracts from GDP.

Comparing the Effects of Inventory Changes on Economic Growth

An increase in inventories can signal that businesses are optimistic about future sales or, alternatively, that sales have slowed unexpectedly, causing unsold goods to accumulate. A decrease may reflect strong sales or a cautious approach to production due to anticipated weaker demand. Both scenarios can lead to fluctuations in headline GDP growth, sometimes distorting the underlying trend of economic activity.

Inventories are a key component in national accounts statistics, as they bridge the gap between production and sales, ensuring GDP figures accurately reflect economic activity over time.

Methods for Tracking Business Inventories

Accurate tracking and valuation of inventories are essential for both financial reporting and operational efficiency. Businesses use several methods to monitor inventory levels and assign costs to goods as they move through the production process.

Inventory Valuation and Tracking Methods

Common inventory management techniques include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and the weighted average method. Each approach has unique implications for financial statements and tax obligations.

| Method | Description | Advantages | Limitations |

|---|---|---|---|

| FIFO (First-In, First-Out) | Assumes the oldest inventory items are sold first. | Reflects actual physical flow; results in higher profits when prices rise. | Can inflate taxable income during inflationary periods. |

| LIFO (Last-In, First-Out) | Assumes the newest inventory items are sold first. | Reduces taxable income during inflation; aligns recent costs with revenues. | Not accepted under IFRS; may understate inventory value in balance sheets. |

| Weighted Average | Costs are averaged across all inventory items available for sale. | Smooths out price fluctuations; simple to apply in practice. | May not reflect actual physical inventory flow; can distort profits in volatile markets. |

Technological Advancements in Inventory Tracking

The adoption of technologies such as barcode scanning, RFID tags, and cloud-based inventory management software has transformed how companies monitor their stock levels. These innovations enable real-time tracking, reduce human error, and provide data analytics for better forecasting and decision-making. Automated systems also facilitate integration with other business functions, such as sales and procurement.

Interpreting Business Inventory Data in Economic Reports

Government agencies, such as the U.S. Census Bureau and statistical offices worldwide, regularly collect and publish data on business inventories. These data releases are closely watched by economists, policymakers, and investors for insights into broader economic trends.

Data Collection and Reporting by Government Agencies

Inventory data is typically gathered through surveys and administrative records from firms across manufacturing, wholesale, and retail sectors. Reports are published on a monthly and quarterly basis, providing information about levels, changes, and ratios relevant to economic analysis.

Significance of Inventory-to-Sales Ratios

Inventory-to-sales ratios are a crucial metric for evaluating the health of businesses and the economy. A rising ratio may signal weakening demand or excessive stock, while a declining ratio suggests robust sales or lean inventories. Tracking these ratios helps analysts assess potential inflection points in the business cycle.

Interpreting Monthly and Quarterly Data Releases

Understanding the meaning behind inventory statistics is important for making informed business and investment decisions. Here are key points to consider when evaluating these data releases:

- Review month-over-month and year-over-year inventory changes for signs of trend reversal.

- Compare inventory growth to sales performance to identify mismatches that could lead to overstock or shortages.

- Pay attention to sector-specific developments, as inventory trends can diverge between industries.

- Monitor revisions in previous reports, as initial estimates may be updated with more complete data.

Historical Trends and Case Studies

Business inventories have played pivotal roles during both economic booms and downturns. By studying historical trends, analysts and policymakers can better anticipate potential risks and opportunities associated with inventory movements.

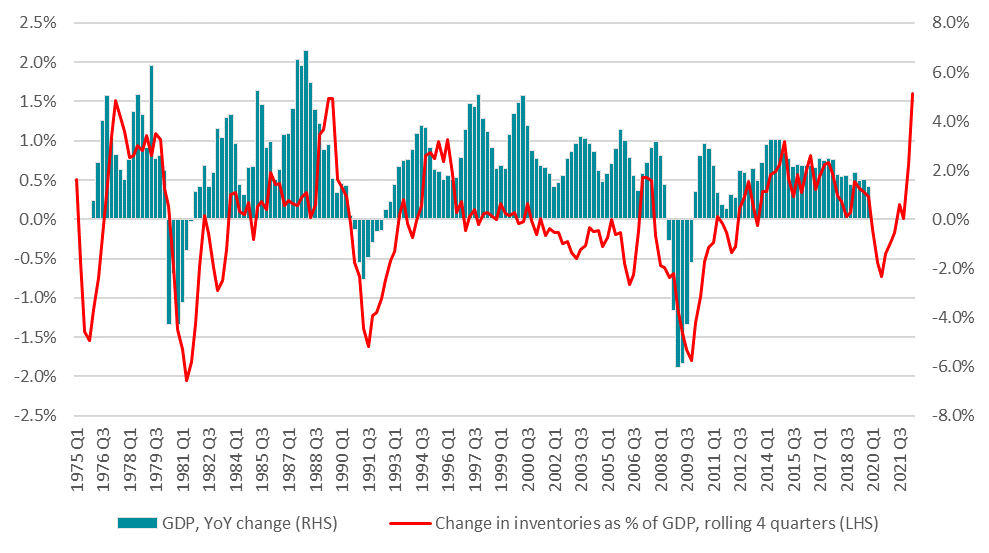

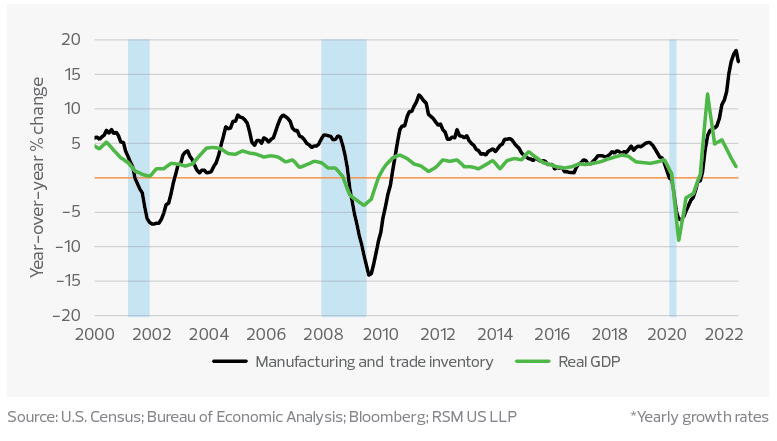

Notable Periods of Inventory Adjustment and GDP Effects

Several periods in recent history illustrate how inventory swings have impacted GDP. For example, during the 2008–2009 global financial crisis, companies rapidly reduced inventories as demand collapsed. Conversely, in the post-pandemic recovery of 2021–2022, many firms struggled to rebuild depleted inventories, contributing to GDP volatility.

| Period | Inventory Trend | GDP Impact | Key Lessons |

|---|---|---|---|

| 2008–2009 Global Financial Crisis | Sharp reduction in inventories across sectors | Significant GDP contraction; inventory drawdown amplified recession | Quick inventory cuts can deepen downturns but prevent overhangs |

| 2010–2011 Economic Recovery | Rebuilding of inventories as demand returned | Boost to GDP from restocking activities | Inventory investment can accelerate recovery phases |

| 2020–2022 Post-COVID Supply Chain Disruptions | Inventory shortages followed by rapid restocking | GDP growth volatility due to mismatched supply and demand | Flexible inventory strategies are critical during global shocks |

Lessons Learned from Past Inventory Cycles

Examining past cycles reveals the importance of adaptability in inventory management. Companies and policymakers must remain vigilant to changing conditions, using real-time data and agile strategies to avoid the pitfalls of excessive stockpiling or shortages. These lessons inform current best practices and guide future economic planning efforts.

Business Inventories in Different Sectors

Inventory management practices vary significantly across sectors, reflecting the unique challenges and operational realities of each industry. Understanding these differences is essential for interpreting overall inventory trends and their implications for the economy.

Comparing Sector-Specific Inventory Management Practices

Manufacturing, retail, and wholesale sectors each face distinct considerations in balancing stock levels. Manufacturers often focus on optimizing raw materials and work-in-process, while retailers prioritize finished goods availability. Wholesalers serve as intermediaries, managing inventories to serve both producers and end sellers.

Sector-Specific Challenges in Inventory Control

Each sector encounters unique hurdles in maintaining optimal inventory. The following points Artikel some of the most common challenges:

- Manufacturing: Managing supply chain disruptions and production lead times

- Retail: Dealing with rapidly changing consumer preferences and seasonal trends

- Wholesale: Coordinating between suppliers and diverse customer bases

- Perishable goods sectors: Minimizing waste and loss due to spoilage

- Technology industries: Preventing obsolescence of high-value inventory

Implications of Sectoral Inventory Shifts on GDP Performance

Shifts in inventory patterns within key sectors can have outsized effects on the broader economy. For instance, a surge in retail inventories ahead of the holiday season can boost quarterly GDP, while a sudden contraction in manufacturing stockpiles may signal a looming slowdown. Policymakers and analysts monitor these sectoral changes to assess the health and trajectory of national economic performance.

Forecasting and Managing Inventory Effects on GDP

Anticipating how inventory changes will affect GDP is a central concern for both businesses and policymakers. Sophisticated models and strategies enable organizations to navigate this complex landscape.

Forecasting Models for Inventory and GDP Impact

Economists rely on forecasting tools such as time-series analysis, input-output models, and advanced econometric techniques to project inventory movements and their implications for GDP. For example, during uncertain periods like the COVID-19 pandemic, real-time inventory and sales data were integrated into GDP nowcasting models to provide timely estimates of economic growth.

Strategies to Optimize Inventories in Response to Economic Signals

Companies employ a mix of strategies to manage inventories dynamically. These include just-in-time inventory systems to minimize holding costs, demand forecasting to align stock levels with sales expectations, and safety stock buffers to mitigate supply chain risks. The integration of advanced analytics and AI has further refined these approaches.

Inventory Management Decisions in Macroeconomic Forecasts

Inventory decisions made at the company level aggregate up to influence national economic statistics. For example, widespread restocking across industries can lead to a temporary surge in GDP, while synchronized drawdowns may foreshadow a slowdown. Understanding this relationship allows both business leaders and policymakers to make more informed decisions in planning for future economic scenarios.

Last Recap

In summary, the interplay between business inventories and GDP provides a window into the economy’s rhythm, revealing cycles of growth and contraction. By keeping an eye on inventory levels and management strategies, businesses and analysts alike can make more informed decisions and adapt to changing economic conditions with greater agility.

Helpful Answers

How do business inventories affect GDP growth?

When inventories increase, it adds to GDP because more goods are produced than sold. Conversely, a decrease in inventory subtracts from GDP as it signals businesses are selling off existing stock instead of producing new goods.

Why do companies keep different types of inventories?

Businesses maintain raw materials, work-in-process, and finished goods inventories to ensure smooth production, meet customer demand promptly, and avoid disruptions caused by supply chain issues.

What does a rising inventory-to-sales ratio indicate?

A rising inventory-to-sales ratio may suggest demand is weakening or businesses are overestimating future sales, prompting closer scrutiny by managers and economists.

How do technological advancements improve inventory tracking?

Technological tools like RFID, inventory management software, and real-time analytics help companies monitor stock levels accurately, reduce errors, and respond quickly to market changes.

Can changes in inventory levels predict upcoming recessions or expansions?

Significant inventory adjustments often precede shifts in the business cycle. Large buildups might signal over-optimism before a slowdown, while rapid drawdowns can indicate preparation for a rebound or improved demand.