business inventories connect with consumption price index is more than just a headline—it’s a dynamic relationship that helps us understand the rhythm of our economy. When businesses adjust their stock levels, it can send ripples through consumer prices, showing how closely these two economic indicators are intertwined. This connection gives insight into what’s happening behind the scenes in markets, shedding light on why prices rise or fall and how businesses and consumers react.

At its core, business inventories represent the goods companies keep on hand, while the consumption price index (CPI) measures the average change in prices paid by consumers. By examining how changes in inventory levels influence the CPI, economists can detect patterns that reveal broader economic trends. Understanding this relationship is essential for businesses planning their next move and policymakers looking to maintain stability in an ever-shifting economic landscape.

Business Inventories and Their Connection with the Consumption Price Index: Business Inventories Connect With Consumption Price Index

Business inventories and the consumption price index (CPI) are two pillars of economic analysis that illuminate how supply chains interact with consumer markets. Understanding the interplay between these metrics offers key insights into price movements, inflationary trends, and the overall dynamics of an economy.

Introduction to Business Inventories and Consumption Price Index

Business inventories refer to the stock of goods that companies hold at any given time, encompassing raw materials, work-in-process, and finished products. These inventories are a crucial signal of business expectations and supply chain health. When inventory levels rise or fall, they reflect shifts in production, consumer demand, and economic forecasts.

The consumption price index (CPI) measures the average change over time in the prices paid by consumers for a basket of goods and services. CPI is widely used as the primary gauge for inflation, affecting policy decisions, cost-of-living adjustments, and business strategies.

The relationship between business inventories and CPI is fundamental in macroeconomics. As inventory levels fluctuate, they often indicate upcoming changes in production activity, which in turn can impact consumer prices. A rise in inventories might signal overproduction, leading to price reductions, while tighter inventories can prompt price increases due to scarcity or heightened demand.

Mechanisms Linking Business Inventories to the Consumption Price Index

The connection between inventory dynamics and CPI revolves around supply and demand. When businesses accumulate excess stock, they may reduce prices to move inventory, putting downward pressure on CPI. Conversely, if inventories are depleted faster than they can be replenished, prices may rise, pushing CPI upward.

Several scenarios illustrate these mechanisms:

- Sudden overstocking in consumer electronics leads to widespread sales, resulting in lower electronics CPI readings.

- Natural disasters disrupt supply chains for food, causing inventory shortages and driving up food prices in CPI.

- Retailers anticipating strong holiday sales increase inventories; if demand falls short, post-holiday discounts lower CPI in relevant categories.

- Manufacturers streamline inventory for efficiency, causing temporary scarcity and a spike in related product prices within CPI.

| Inventory Event | CPI Impact | Economic Context | Outcome |

|---|---|---|---|

| Inventory buildup | Downward pressure | Excess production, weak demand | Discounting, CPI drop |

| Inventory depletion | Upward pressure | Strong demand, supply constraints | Price increases, CPI rise |

| Stable inventory levels | Minimal impact | Balanced supply and demand | Steady CPI |

| Supply chain disruption | Sharp increase | Unforeseen events, e.g. pandemics | CPI volatility |

Economic Theories Supporting the Relationship, Business inventories connect with consumption price index

Various economic frameworks explain how inventories and price levels interact. Classical theory often presumes that prices adjust rapidly to clear inventory imbalances, while Keynesian theory emphasizes the lagged effects of inventory changes on production and prices.

“In a dynamic economy, inventory adjustments serve as both a buffer and a signal, mediating the transmission of demand shifts into pricing behavior.”

“Keynesian models suggest that inventory swings amplify business cycles, influencing output and, by extension, price levels.”

| Theory | Inventory Role | Price Impact | Relevance |

|---|---|---|---|

| Classical | Buffer stocks, market clearing mechanism | Quick price adjustments | Short-term inventory changes absorbed by price |

| Keynesian | Amplifies business cycles, lags in adjustment | Delayed price effects, potential overshooting | Explains persistent inflation or deflation |

| Monetarist | Inventory affects money velocity | Indirect influence on price level | Relevant during rapid credit expansion or contraction |

Methods for Measuring and Analyzing the Connection

Quantitative analysis of the inventory-CPI relationship relies on various statistical approaches, including correlation analysis, time-series modeling, and regression techniques. Analysts often use lagged variables to capture delayed effects of inventory changes on CPI.

A typical flowchart for analyzing these effects involves:

- Collecting time-series data for business inventories and CPI across relevant sectors.

- Cleaning and adjusting data for seasonal effects and anomalies.

- Running statistical tests to determine correlation and causality.

- Building econometric models to forecast CPI based on inventory movements.

- Validating models using out-of-sample testing and scenario analysis.

| Data Source | Frequency | Variables Included | Relevance |

|---|---|---|---|

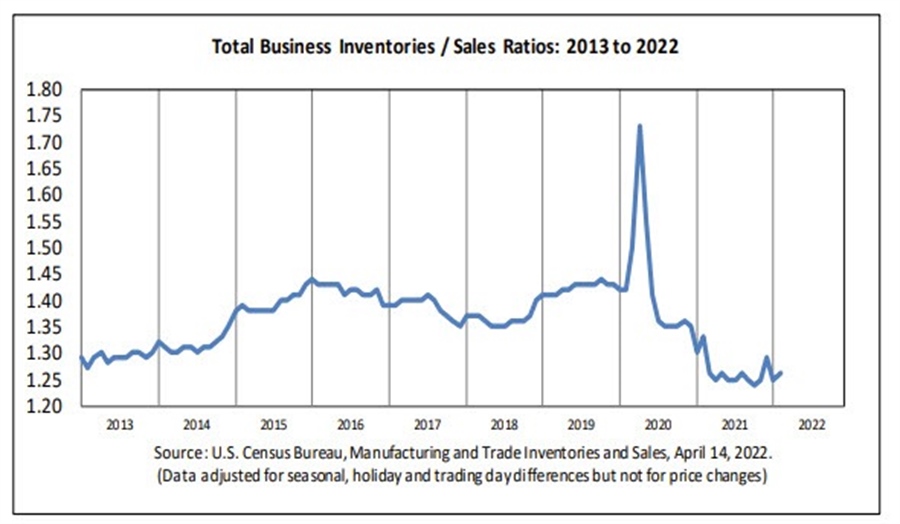

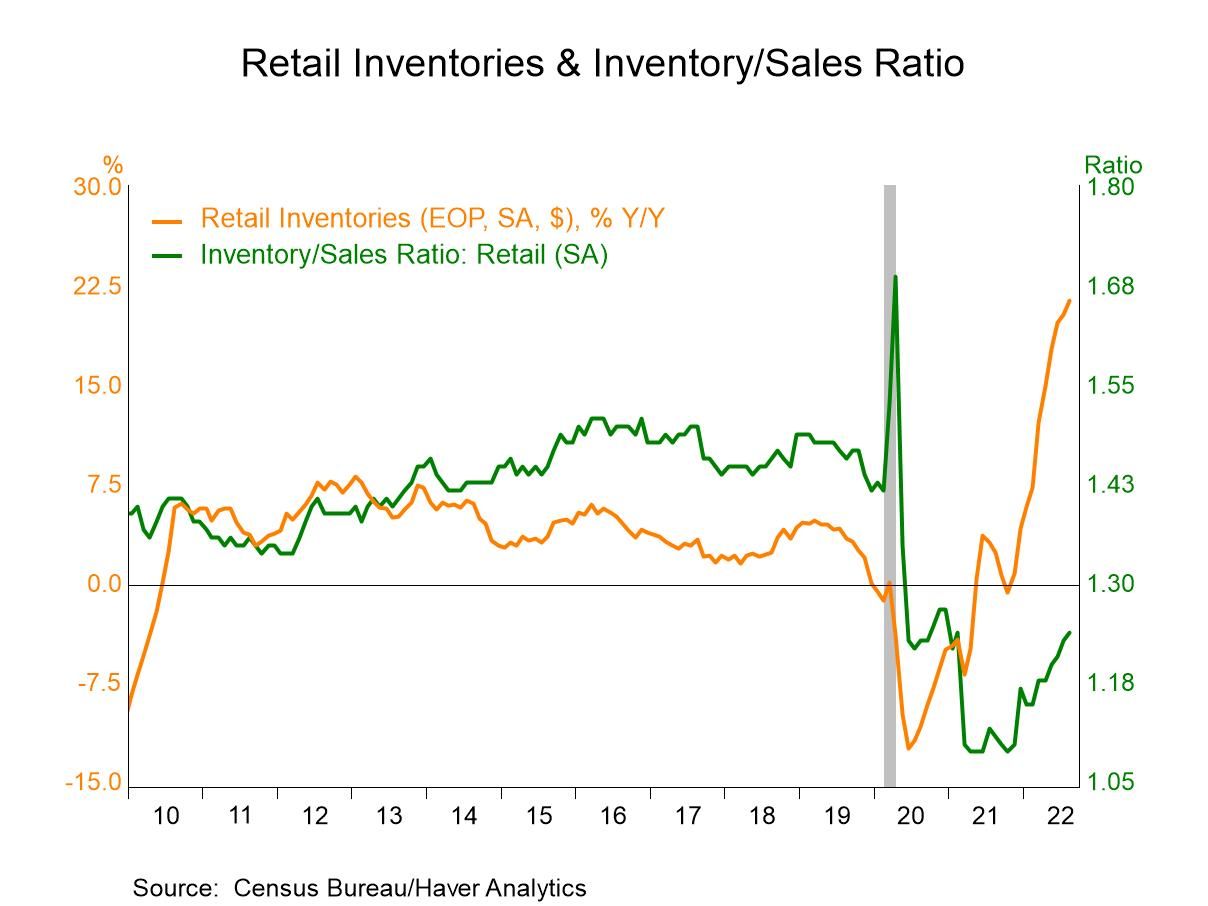

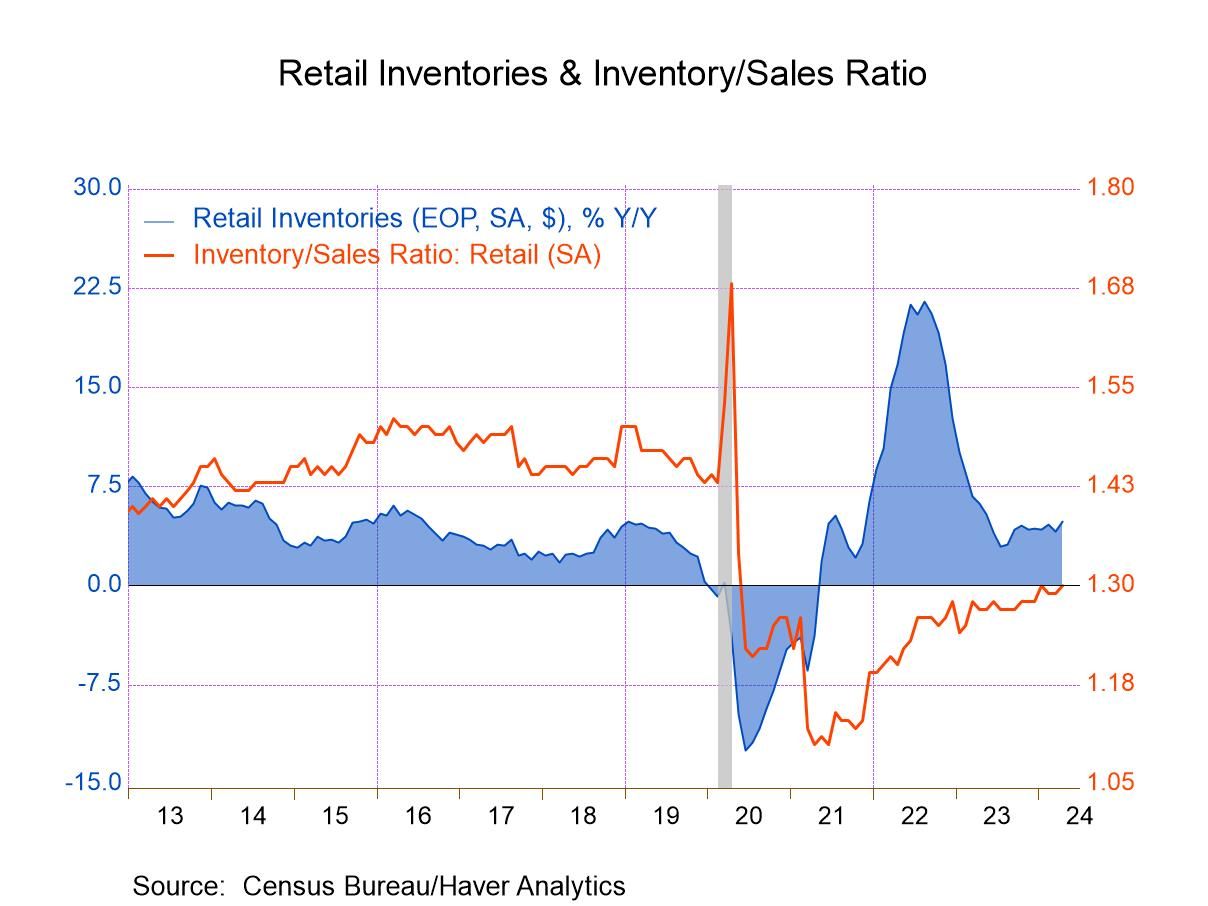

| US Census Bureau: Monthly Wholesale Trade Survey | Monthly | Inventory value, sales, stock-to-sales ratio | Key for tracking short-term inventory trends |

| Bureau of Labor Statistics: Consumer Price Index | Monthly | Itemized price indexes, sector breakdowns | Primary inflation indicator |

| Federal Reserve Economic Data (FRED) | Varies | Macroeconomic aggregates, inventory ratios | Comprehensive context for modeling |

Case Studies of Inventory and CPI Dynamics

Historical cases demonstrate how inventory shifts have influenced CPI outcomes. By analyzing specific events, patterns emerge that inform both business and policy responses.

In 2008, during the global financial crisis, many retailers faced unsold inventory as consumer demand dropped. To clear stock, aggressive discounting occurred, contributing to disinflation and even deflation in some CPI categories. In contrast, the COVID-19 pandemic in 2020 caused rapid inventory depletion—especially in essential goods—leading to shortages and significant price increases captured in the CPI.

- The 2008 crisis highlighted the risk of overestimating demand and the deflationary impact of widespread discounting.

- The 2020 pandemic illustrated how sudden supply chain disruptions and panic buying can drive up prices amid inventory shortages.

- Retailers who adapted inventory management practices better weathered demand shocks and price volatility.

- Rapid shifts in inventory policy can either stabilize or destabilize consumer prices, depending on timing and scale.

| Date | Inventory Change | CPI Change | External Factors |

|---|---|---|---|

| Q1 2008 | Inventory buildup, unsold goods | CPI slowed, some categories negative | Financial crisis, collapsing demand |

| Q2 2020 | Rapid inventory depletion, stockouts | CPI spike in food, cleaning supplies | Pandemic, supply chain disruptions |

| Q4 2021 | Inventory rebuilding, cautious restocking | Gradual CPI stabilization | Post-pandemic recovery, logistical improvements |

Practical Implications for Businesses and Policymakers

Monitoring inventory and CPI data provides actionable intelligence for companies and governments. Businesses can optimize inventory levels to anticipate price changes and adjust procurement or sales strategies accordingly. Policymakers use these signals to gauge inflation risks, inform interest rate decisions, and implement stabilization measures.

- Retailers align purchasing schedules with seasonal CPI trends to minimize overstocking and markdowns.

- Manufacturers adjust production runs based on inventory-to-sales ratios, reducing the risk of price volatility.

- Central banks monitor inventory data to anticipate inflationary or deflationary pressures before adjusting monetary policy.

- Governments may use tax incentives or subsidies to stabilize critical inventories and prevent excessive consumer price swings.

Challenges and Limitations in Connecting Inventories to CPI

Despite the strong conceptual link, certain challenges complicate the direct analysis of inventories and CPI. These include data lags, sectoral differences, and confounding macroeconomic variables like energy prices or global demand shocks.

| Challenge | Description | Effect on Analysis | Possible Solution |

|---|---|---|---|

| Data lag | Time delay between inventory reporting and CPI publication | Makes real-time analysis difficult | Use nowcasting techniques and high-frequency proxies |

| Sectoral differences | Inventories and prices move differently across industries | Aggregate analysis may mask important dynamics | Disaggregate by sector or product category |

| External shocks | Factors such as oil price spikes or pandemics | Distorts the inventory-CPI relationship | Apply event study methodologies, control for exogenous events |

| Measurement errors | Discrepancies in reported inventory and price data | Reduces reliability of findings | Cross-validate data, improve statistical audits |

Addressing these challenges often requires innovative data collection, advanced modeling, and ongoing collaboration between statisticians, economists, and industry practitioners to improve both measurement and interpretation.

Wrap-Up

In summary, the link between business inventories and the consumption price index is a valuable piece of the economic puzzle. By monitoring inventory changes alongside price trends, decision-makers gain a clearer picture of market health and future developments. Keeping an eye on these indicators helps both businesses and governments adapt strategies, respond to economic challenges, and anticipate what lies ahead for consumers and the economy as a whole.

Helpful Answers

Why do business inventories impact the consumption price index?

When businesses have high inventories, they may lower prices to move products, which can lead to a decrease in the CPI. Conversely, low inventories often result in higher prices, influencing the CPI upwards.

How can tracking inventories help forecast inflation?

Inventory trends can signal future price changes. Large inventory buildups might indicate potential price drops, while shrinking inventories can point to upcoming inflation seen in the CPI.

Are all industries affected equally by the inventory and CPI connection?

No, industries with fast-moving consumer goods or seasonal products often see stronger effects, while sectors with slower turnover may have a less direct impact on the CPI.

Can changes in consumer demand break the link between inventories and CPI?

Significant shifts in consumer demand can disrupt the usual inventory-CPI relationship, either amplifying or diminishing the expected effects of inventory changes on prices.

What role do global supply chains play in this relationship?

Global supply chains add complexity, as inventory fluctuations in one country can impact the CPI both locally and abroad, depending on trade volumes and logistical factors.