business inventories climbed sets the stage for this enthralling narrative, offering readers a glimpse into a story that captures the dynamics of supply chains and what happens when inventory levels start to rise across industries.

Business inventories, which include raw materials, work-in-progress items, and finished goods, are a key part of how companies operate efficiently. When inventories climb, it often signals changes in production planning, demand shifts, or supply chain challenges. Monitoring these increases helps businesses and economic analysts spot patterns, assess risks, and devise strategies for inventory management and logistics. Understanding why inventories go up and how they impact the economy provides valuable insight for decision makers across the board.

Business Inventories Overview: Business Inventories Climbed

Business inventories play a central role in the smooth functioning of supply chains across industries. Serving as buffers between different stages of production and distribution, inventories enable businesses to meet demand fluctuations and protect against supply disruptions. Inventory management is therefore a crucial business function, directly impacting profitability and operational efficiency.

Inventories are broadly categorized based on their position within the production process. Each type serves a unique purpose and presents its own set of management challenges. Understanding these categories helps businesses allocate resources efficiently and design robust supply chain strategies.

Main Inventory Categories and Characteristics, Business inventories climbed

The three fundamental types of inventories are raw materials, work-in-progress (WIP), and finished goods. Each type contributes to overall operational flexibility and requires tailored management approaches.

| Inventory Category | Description | Common Examples | Key Characteristics |

|---|---|---|---|

| Raw Materials | Basic inputs required for production | Steel, wood, chemicals, grains | Directly affected by supplier reliability and lead times |

| Work-in-Progress (WIP) | Goods currently in production but not yet completed | Partially assembled electronics, half-processed textiles | Represents capital tied up in the production process |

| Finished Goods | Completed products ready for sale or distribution | Cars, packaged food, consumer electronics | Directly linked to sales cycles and customer demand |

Recent Trends in Climbing Inventories

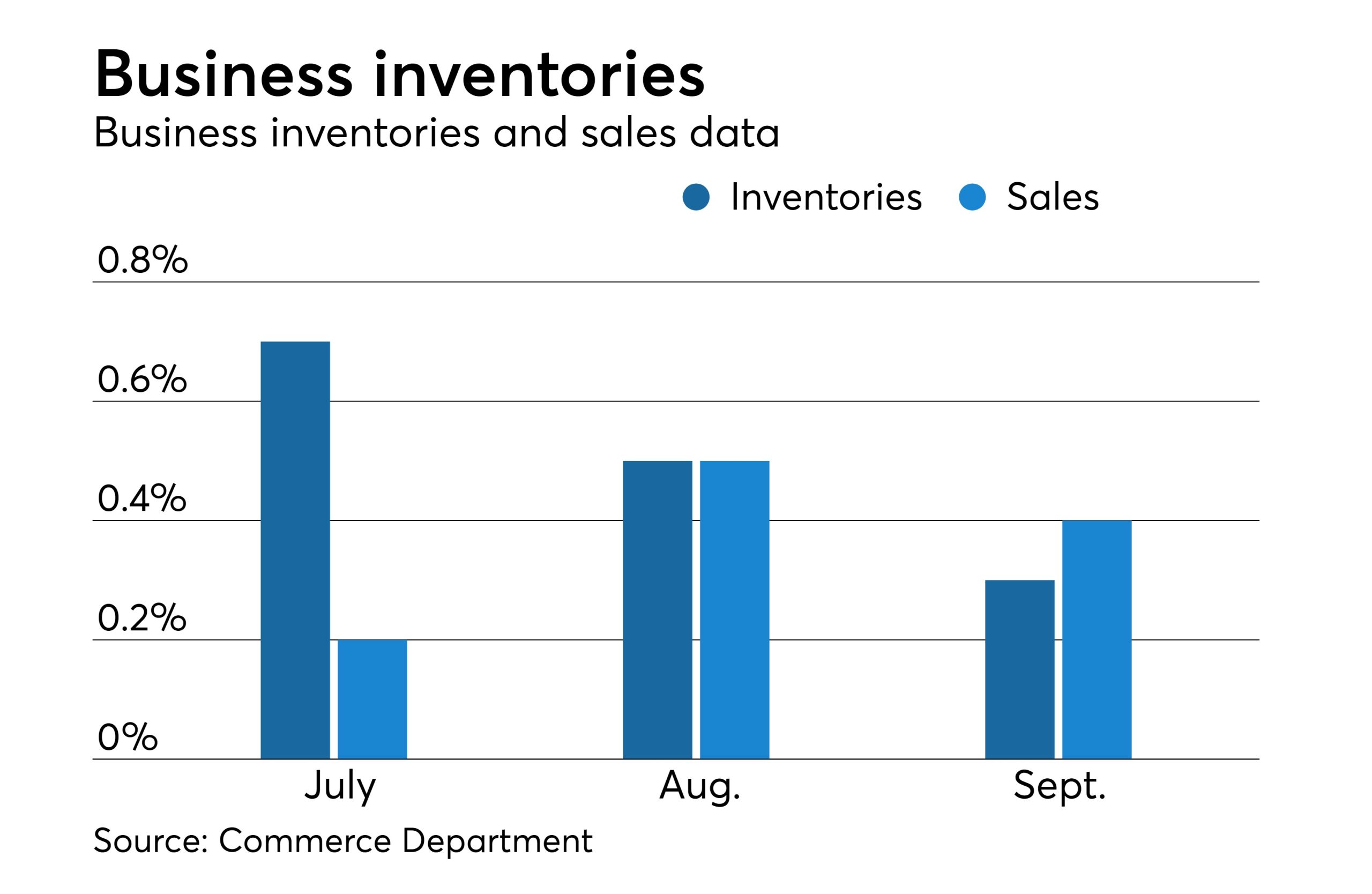

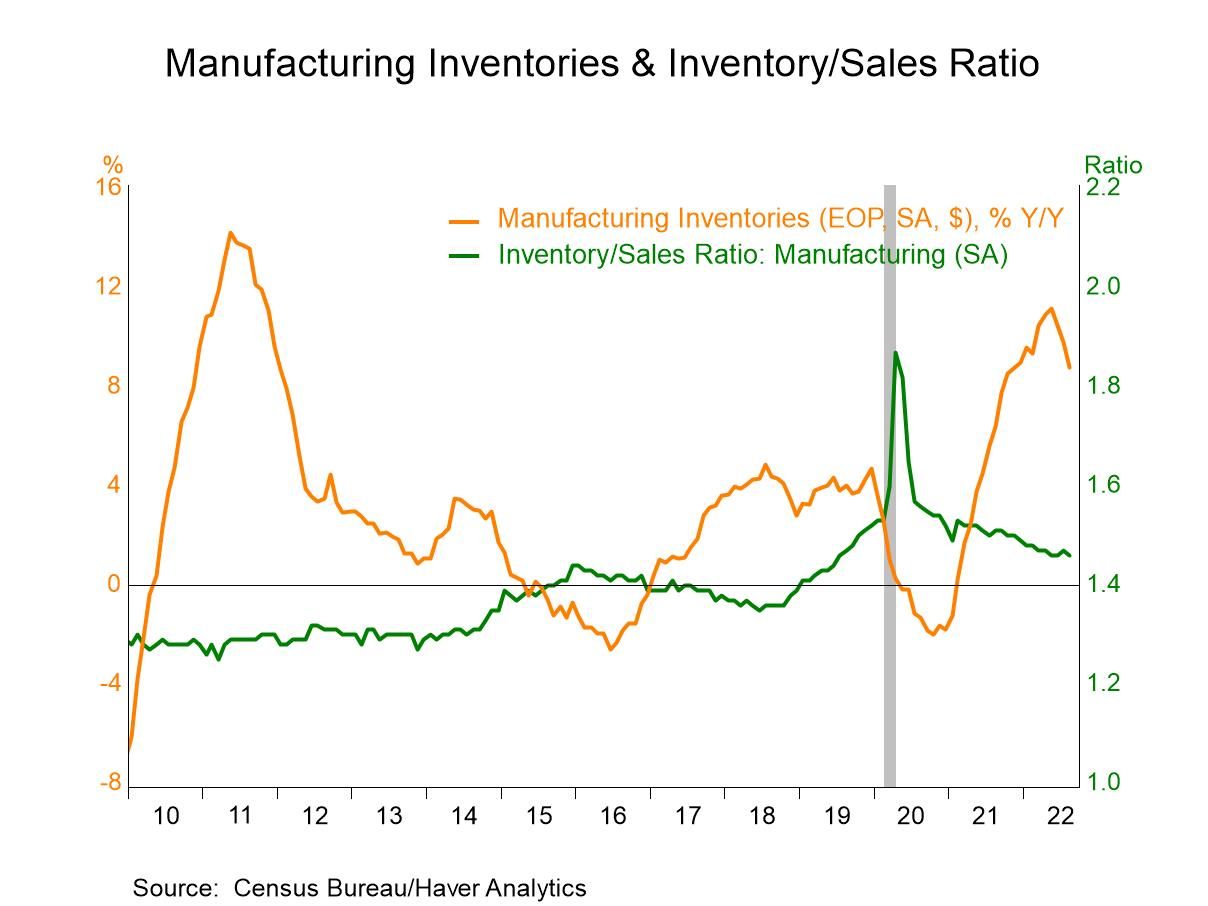

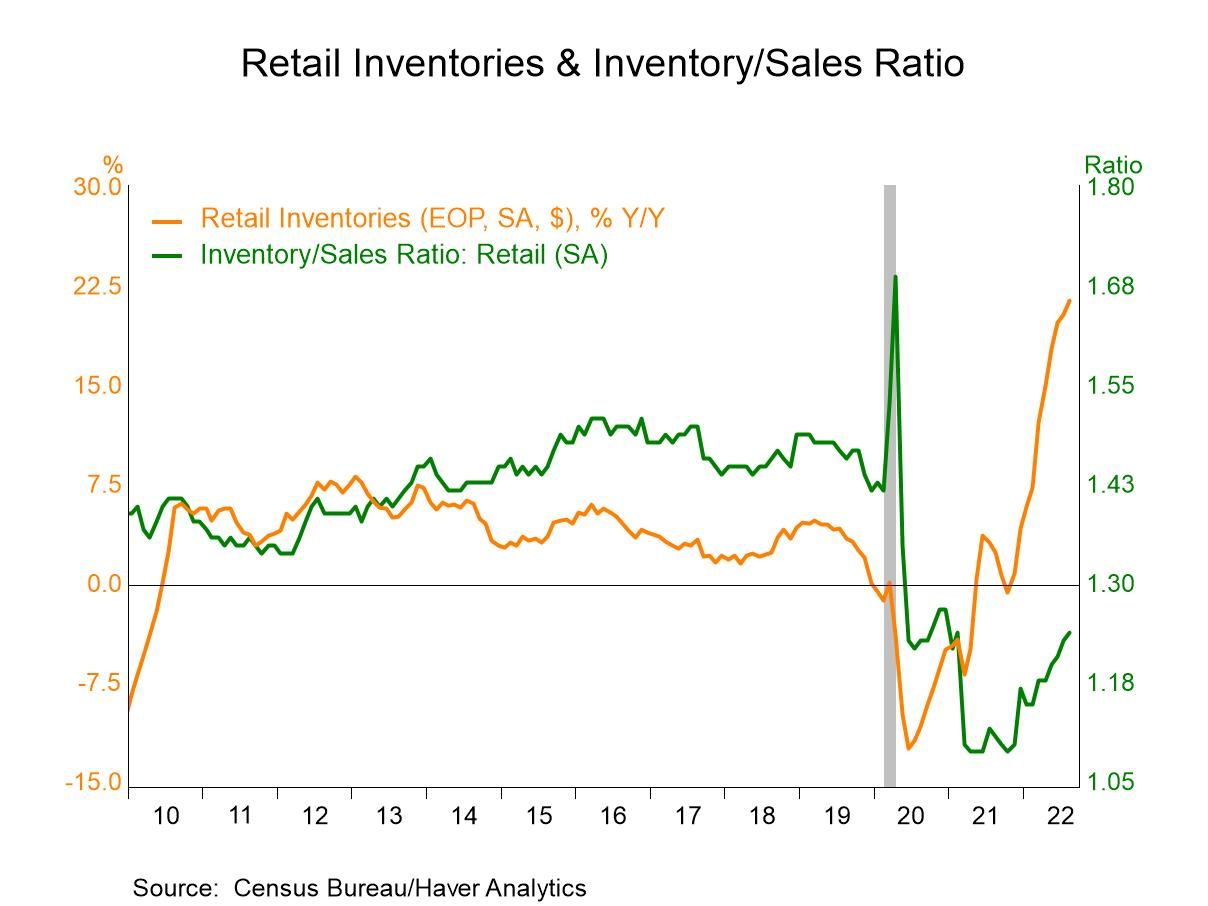

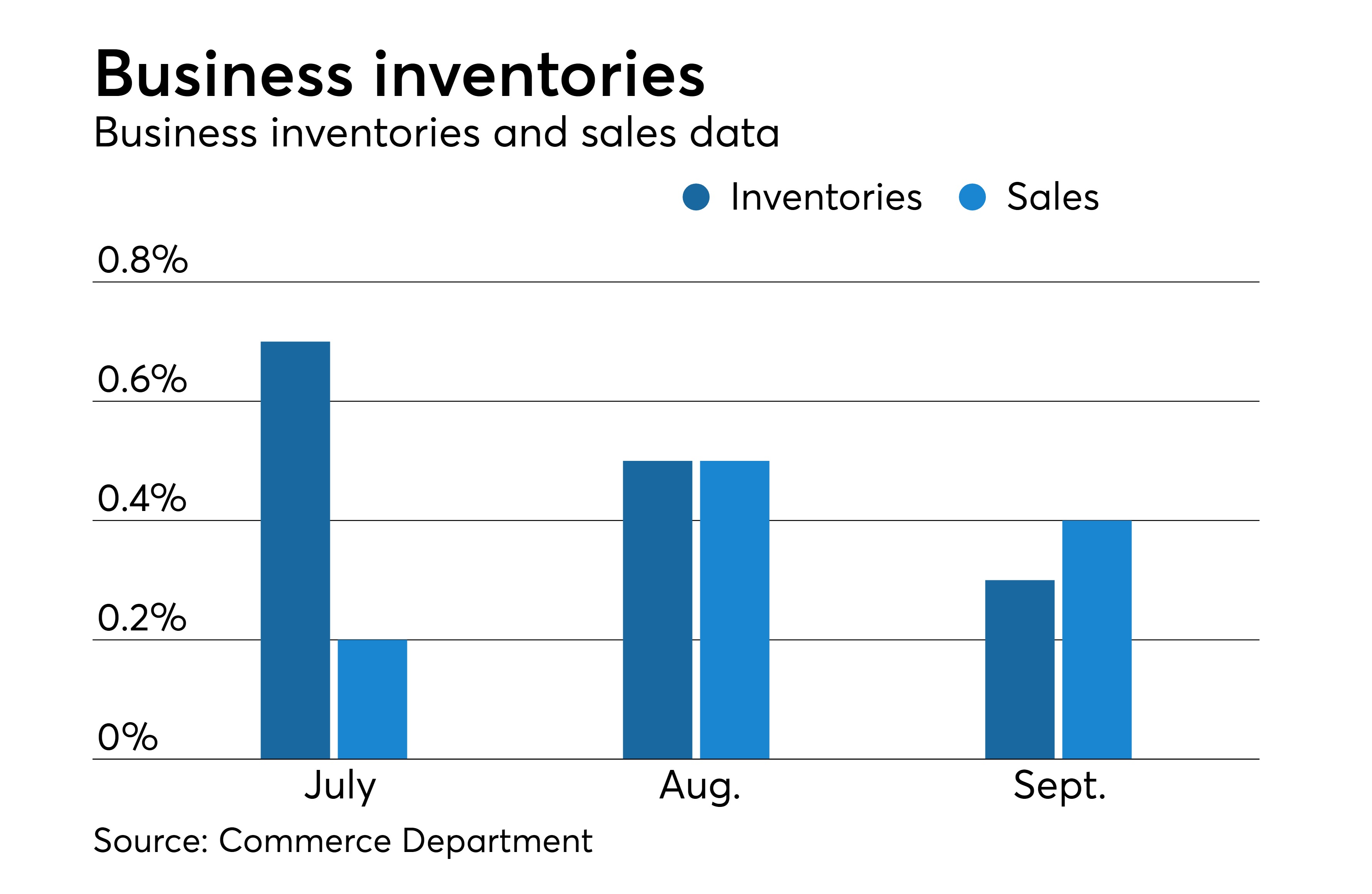

Over the past few years, business inventories have experienced notable fluctuations, with several periods marked by significant climbs. These increases often align with macroeconomic events, global disruptions, and changing consumer patterns. Chronologically, surges in inventory levels have frequently occurred during and after major global events—such as the COVID-19 pandemic—when supply chain bottlenecks and demand uncertainties prevailed.

Certain industries have been particularly impacted by these trends. The following examples highlight sectors most affected by recent inventory builds:

- Automotive: Semiconductor shortages led to backlog and excess parts stockpiling.

- Retail: Rapid shifts in consumer preferences caused apparel and electronics inventories to swell.

- Consumer Packaged Goods: Panic buying and supply disruptions prompted overstocking of household essentials.

- Technology: Fluctuating demand and logistics delays resulted in inventory surpluses of devices and components.

Seasonal variations and unexpected disruptions frequently accelerate inventory accumulation. For instance, during the 2021 holiday season, retailers increased their inventory purchases much earlier than usual, anticipating shipping delays. This led to warehouses reaching capacity well before peak shopping periods, creating both logistical challenges and carrying costs.

Causes Behind Inventory Accumulation

The build-up of business inventories is rarely the result of a single factor. Instead, it often stems from a combination of supply chain constraints, inaccurate demand forecasts, and external shocks. Recognizing these causes allows businesses to respond proactively and minimize inefficiencies.

A comparison of key contributors to rising inventories is detailed below:

| Factor | Supply Chain Challenges | Shifts in Consumer Demand | External Events |

|---|---|---|---|

| Description | Delays, shortages, or disruptions in sourcing materials or components | Sudden increases or decreases in market demand | Pandemics, geopolitical conflicts, natural disasters |

| Impact Example | Shipping container shortages causing goods to be stuck in transit | Unexpected drop in sales leading to unsold inventory | Factory shutdowns due to lockdowns or trade restrictions |

Production planning and demand forecasting errors are also significant drivers of inventory accumulation. When forecasts overestimate demand, businesses may ramp up production, resulting in surplus inventory if actual sales fall short. Similarly, poor integration of market trends and real-time data can lead to mismatches between inventory levels and current demand, tying up capital and increasing storage costs.

Economic Implications of Inventory Changes

Business inventories are closely linked to broader economic health and fluctuations. Changes in inventory levels can signal shifts in production activity, demand trends, and overall business sentiment. Elevated inventories often indicate either a slowdown in sales or anticipation of future demand, both of which have ripple effects across the economy.

Mounting inventories can dampen GDP growth if businesses curtail production in response to excess stock. Profit margins may shrink as companies contend with increased holding costs, markdowns, or obsolescence. Furthermore, inventory build-ups can influence employment levels, as firms adjust workforce needs based on production schedules and inventory turnover rates.

The following table summarizes key economic indicators related to inventory changes:

| Indicator | Relationship to Inventories | Implication |

|---|---|---|

| Gross Domestic Product (GDP) | Rising inventories can boost short-term GDP, but persistent increases may signal economic slowdown | Adjustment in production levels and business confidence |

| Business Profits | Higher inventory costs and potential markdowns reduce profitability | Increased risk of write-downs or obsolete stock |

| Employment | Changes in inventory often lead to shifts in hiring, layoffs, or overtime | Direct impact on labor market and wage trends |

Final Conclusion

In summary, business inventories climbed not only reveals trends within companies but also sheds light on broader economic changes. By exploring the causes, industry specifics, and the effects on supply chains and forecasting, we gain a better understanding of how businesses can adapt and thrive in shifting market conditions.

Detailed FAQs

What does it mean when business inventories climbed?

It means that the total stock of goods held by businesses has increased, which could be due to overproduction, lower sales, or supply chain delays.

How do rising inventories affect cash flow?

Higher inventories tie up cash in unsold goods, which can reduce liquidity and limit a company’s ability to invest elsewhere.

Are climbing inventories always a negative sign?

No, climbing inventories can be temporary and sometimes indicate that a business is preparing for higher future demand or seasonal spikes.

Which industries are most sensitive to inventory changes?

Retail, manufacturing, and technology sectors typically respond quickly to inventory fluctuations due to their fast-moving products and supply chains.

How can companies prevent excess inventory buildup?

By using accurate forecasting, just-in-time practices, and real-time inventory tracking, businesses can maintain optimal inventory levels and avoid overstocking.